For political strategists and enthusiasts alike, there’ve been quite a few unprecedented events in the 2024 election cycle to say the least. Despite all this, we’re staying focused! Revitalize your understanding of the intersection between politics and advertising with The Political Pulse. Dive into the intricate dynamics of the 2024 U.S. election as we dissect its influence on media expenditure in pivotal U.S. markets. Enjoy our August 2024 issue.

GOP U.S. Senate Ad Strategy: The Path of Least Resistance

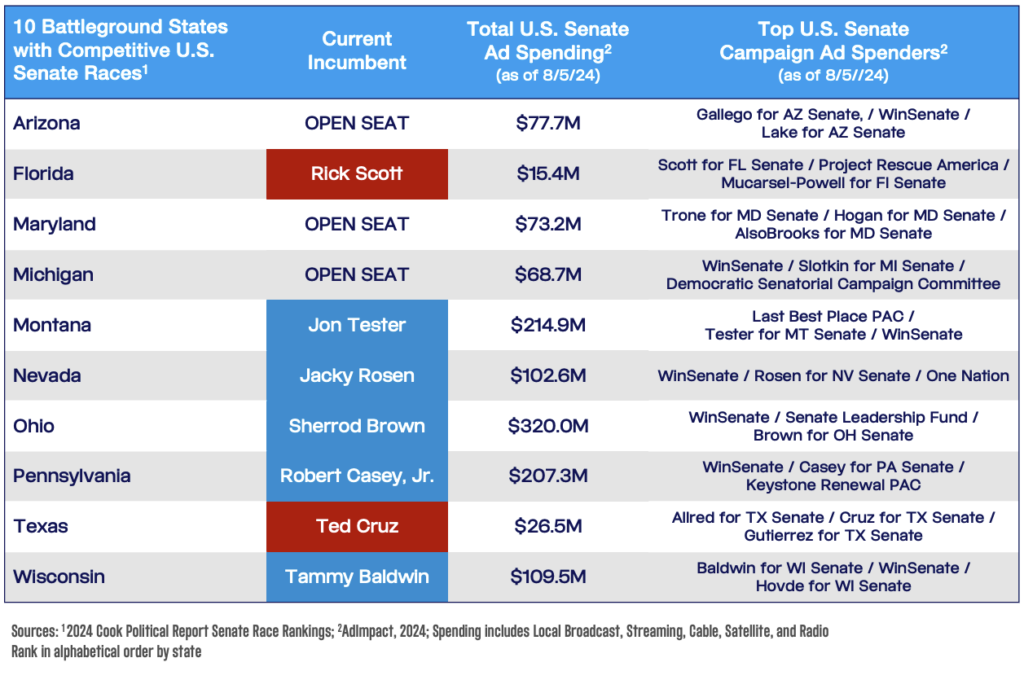

We’ll open with the one thing that hasn’t changed. As the 2024 election approaches, the GOP is intensifying its ad spending in key states to reclaim control of the U.S. Senate. Focusing on red states with legacy Democratic senators, Republicans view this as potentially the path of least resistance. Significant resources are being directed toward unseating Democratic Senators Jon Tester (MT) and Sherrod Brown (OH). Both states lean heavily toward Trump, giving the GOP an overall advantage and making these Senate races top targets for the GOP.

In addition to Montana ($214.9M spent to date) and Ohio ($320.0M spent to date), GOP spending is also targeting open seats in Arizona ($77.7M spent to date), Michigan ($68.7M spent to date), and, to a lesser extent, Maryland ($73.2M spent to date). While Maryland appears less competitive at this moment, Arizona and Michigan present crucial opportunities for Republican gains. As reported by AdImpact, these states are witnessing a surge in local political ad spending as the GOP aims to flip these seats and we anticipate this surge to continue.

Furthermore, the GOP is focusing on Democratic-held seats in swing states like Nevada ($102.6M spent to date), Pennsylvania ($207.3M spent to date), and Wisconsin ($109.5M spent to date). These states, with their mixed electorates and pivotal roles in national politics, are seeing extensive ad campaigns aimed at swaying undecided voters. The competitive nature of these races is driving significant investments in local broadcast, digital / streaming, and grassroots efforts.

Overall, the GOP’s strategic ad spending in these ten key states underscores their determination to retake the U.S. Senate, helping make the 2024 election cycle one of the most heavily funded in recent history.

Down-ballot Initiatives Drive Up Political Ad Spending

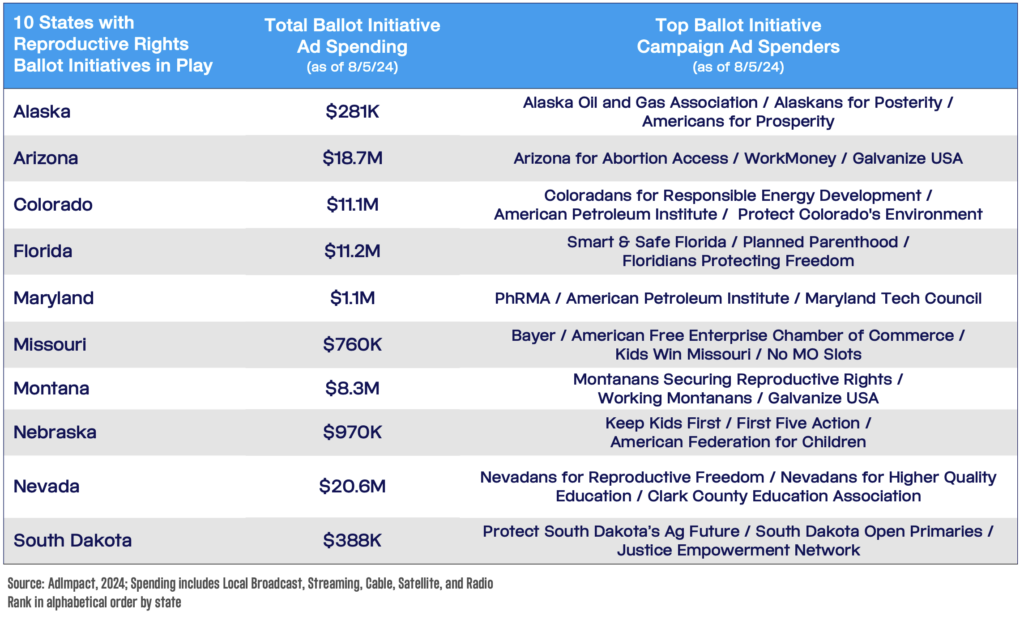

In the wake of the Dobbs decision, supporters of women’s reproductive rights have been racing to place ballot initiatives on election ballots in every state that allows them. These initiatives, aimed at either enshrining reproductive rights or fending off further restrictions, have garnered substantial local political ad spending in 2024.

Confirmed ballot initiatives in Colorado ($11.1M spent to date), Florida ($11.2M spent to date), Maryland ($1.1M spent to date), Nevada ($20.6M spent to date), and South Dakota ($388K spent to date) are already seeing significant investments in local advertising. Campaigns in these states are focused on mobilizing voters and ensuring their support for reproductive rights. Arizona ($18.7M spent to date), Missouri ($760K spent to date), Montana ($8.3M spent to date), and Nebraska ($970K spent to date) are in the process of confirming signatures to secure their place on the ballot. Additionally, proponents in Alaska ($281K spent to date) are appealing the Secretary of State’s disqualification to get their initiative reinstated.

Historically, each initiative addressing reproductive rights has attracted heavy spending in local media from both supporters and opponents. This trend continues in 2024, with substantial funds being poured into local advertising to sway public opinion. The high stakes and passionate advocacy surrounding these issues have led to successful campaigns, either protecting reproductive rights or preventing further restrictions.

As the election approaches, expect ad spending to intensify in these states, reflecting the critical importance of these initiatives to voters and the broader national debate on reproductive rights. AdImpact‘s data below, lists year-to-date Ballot Initiative ad spending in each state where reproductive rights are in play during this election cycle:

Presidential and a Shift in Overall Political Ad Spending

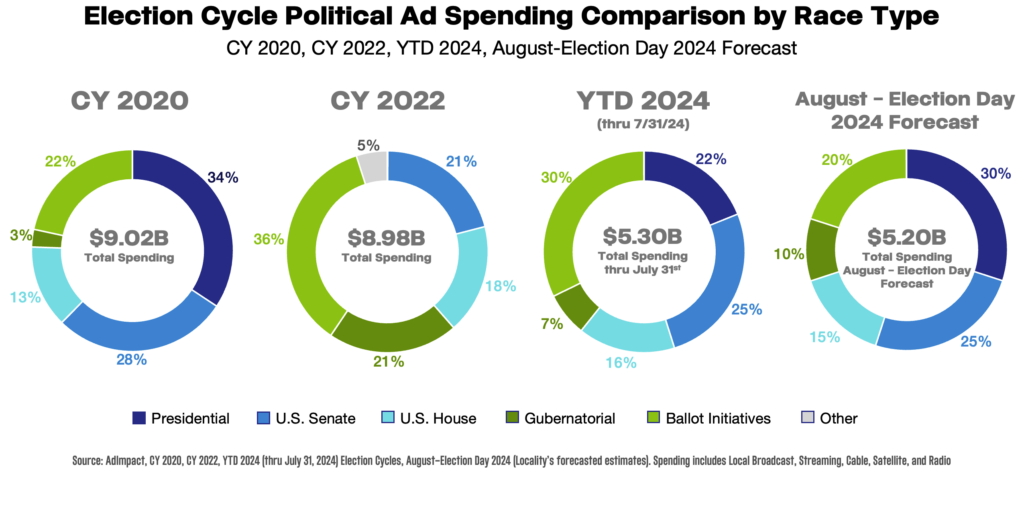

Last up, the big one: Presidential spending. Before the recent seismic changes, the first seven months of the 2024 election cycle were atypical. Political ad spending had shifted significantly compared to previous Presidential election years, with increased focus on U.S. Senate races and ballot initiatives. As mentioned earlier, this trend has been especially notable in states like Ohio and Montana, where “hot” Senate races continue to draw substantial local ad investment reflecting their critical importance in the current political landscape.

However, as we move closer to Election Day, we forecast a shift in spending patterns. With the Democratic ticket becoming clearer and the GOP ramping up Presidential ad spending post-Republican National Convention (RNC), we anticipate a surge in Presidential campaign expenditures bringing them back towards historical averages.

Locality’s political experts predict the overall spending split from August to Election Day to transition to approximately 30% for Presidential campaigns, 25% for U.S. Senate races, 15% for U.S. House campaigns, and 30% for gubernatorial and down-ballot races. Despite this shift, Senate races in highly contested states are expected to remain extremely competitive and continue to attract significant local political ad spending.

This evolving landscape underscores the dynamic nature of political ad spending in the 2024 election cycle, with campaigns strategically allocating resources to maximize their impact as the race intensifies. Locality estimates that overall U.S. election cycle political ad spending will reach $10.5 billion in 2024. The chart below, using AdImpact’s data, compares the share of political ad spending by race type—Presidential, U.S. Senate, U.S. House, Gubernatorial, and Ballot Initiatives—in CY 2020, CY 2022, YTD 2024, and our forecast for August to Election Day:

Impact of the Democratic VP Nominee on Ad Spending

One last note on the Harris VP pick and spending: while the selection of Gov. Tim Walz could have a major impact on the campaign’s strategic approach, it is expected to have limited to no effect on the overall spending trajectory. The focus will remain on maximizing voter outreach and influence through sustained, high-level local ad investments. It will be challenging to add more than was already anticipated in key Presidential battleground states and highly unlikely that either campaign would spend less.

At Locality, we are tracking every race, every ballot initiative, and many more 2024 election cycle moments that will impact ad spending across local TV and streaming. Get in touch if you’d like to discuss local advertising solutions for your campaigns. We’re always happy to chat about Politics.