Revitalize your understanding of the intersection between politics and advertising with The Political Pulse. Dive into the intricate dynamics of the 2024 election as we dissect its influence on media expenditure in pivotal U.S. markets as political ad spending surges in key battleground states during the final sprint to Election Day. Enjoy our October 2024 edition.

Presidential Election: Battleground States Key to Victory

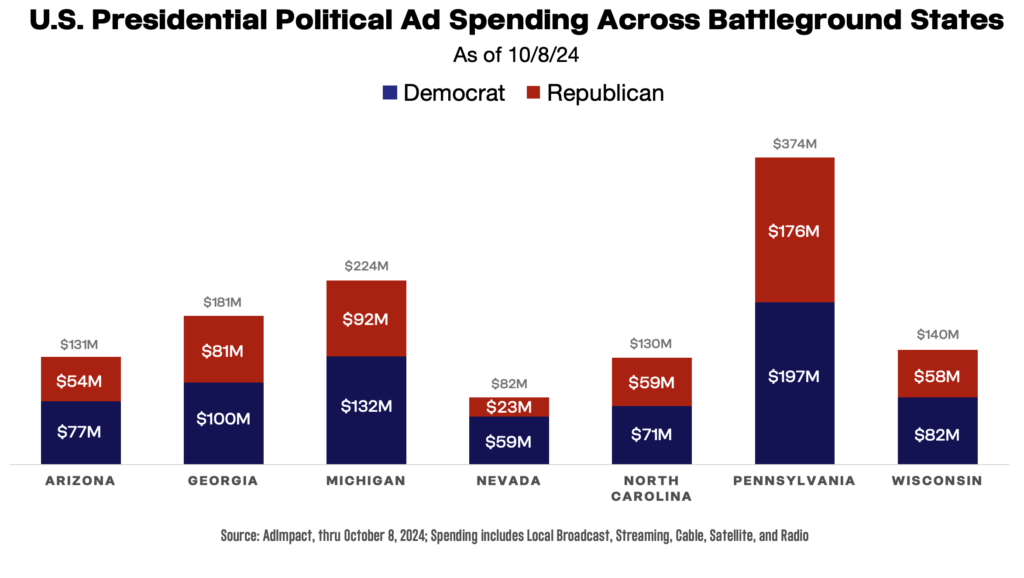

This is it! The final sprint of the 2024 Presidential election is underway, and local ad spending is ramping up as candidates focus on critical battleground states. Polling remains extremely tight, and this race could be the third in a row where a few thousand voters in a handful of states decide the outcome.

The Harris campaign is taking an expansive approach, backed by strong fundraising efforts. Their preferred path to victory runs through key Frost Belt states: Wisconsin ($82M spent to date), Michigan ($132M spent to date), and Pennsylvania ($197M spent to date). However, their ad dollars are also targeting voters in swing states like Arizona ($77M spent to date), Georgia ($100M spent to date), North Carolina ($71M spent to date), and Nevada ($59M spent to date), leaving no stone unturned in their quest for crucial electoral votes.

On the other side, the Trump campaign is playing a more focused game, pouring the bulk of their resources into Georgia ($81M spent to date), Michigan ($92M spent to date), North Carolina ($59M spent to date), and Pennsylvania ($176M spent to date). While their map is tighter, these states are pivotal, and the campaign’s messaging is concentrated on rallying voters in areas where they see the highest potential for success.

With both campaigns locked in a high-stakes battle, this final push in political ad spending will be decisive in determining which path leads to the White House. The question remains: which handful of states will tip the balance? AdImpact‘s data below, ranks year-to-date Presidential ad spending in each battleground state by campaign:

U.S. Senate Majority Hinges on Tightly Contested States

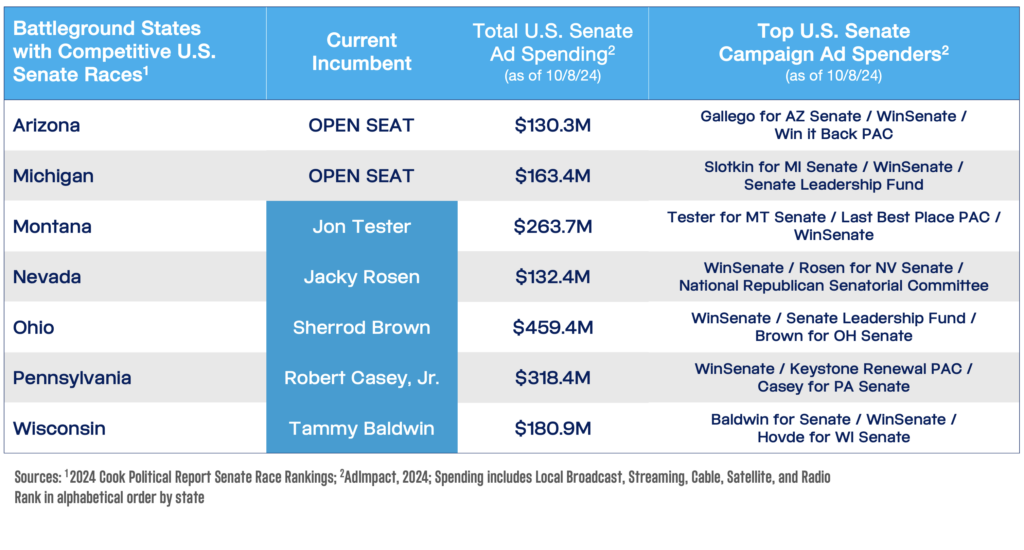

In the 2024 U.S. Senate elections, the stakes couldn’t be higher, with Republicans needing just one additional seat to take control of the chamber. As a result, Democrats are playing defense in more states than they’d prefer, trying to protect key seats in battlegrounds across the country.

One of the most vulnerable incumbents is Sen. Jon Tester of Montana ($263.7M spent to date), whose re-election bid is increasingly in danger as GOP spending ramps up. However, Tester is not the only Democrat facing fierce competition. According to the 2024 Cook Political Report, Senate races in Arizona ($130.3M spent to date), Michigan ($163.4M spent to date), Nevada ($132.4M spent to date), Ohio ($459.4M spent to date), Pennsylvania ($318.4M spent to date), and Wisconsin ($180.9M spent to date) remain within the margin of error, with polls too close to call. These states are also pivotal in the Presidential race, meaning additional layers of local ad spending will flood the airwaves as candidates from both parties aim to sway undecided voters.

With control of the Senate at stake, both parties are pouring money into these local competitive races. Democrats are determined to hold the line, while Republicans are laser-focused on flipping even one seat to gain the majority. In these final weeks, the balance of local political ad spending will play a critical role in determining the outcome, with millions being funneled into these battleground states. As reported by AdImpact, these Senate battleground states are witnessing a surge in local political ad spending:

Ad Blitz Hits Battleground U.S. House Districts

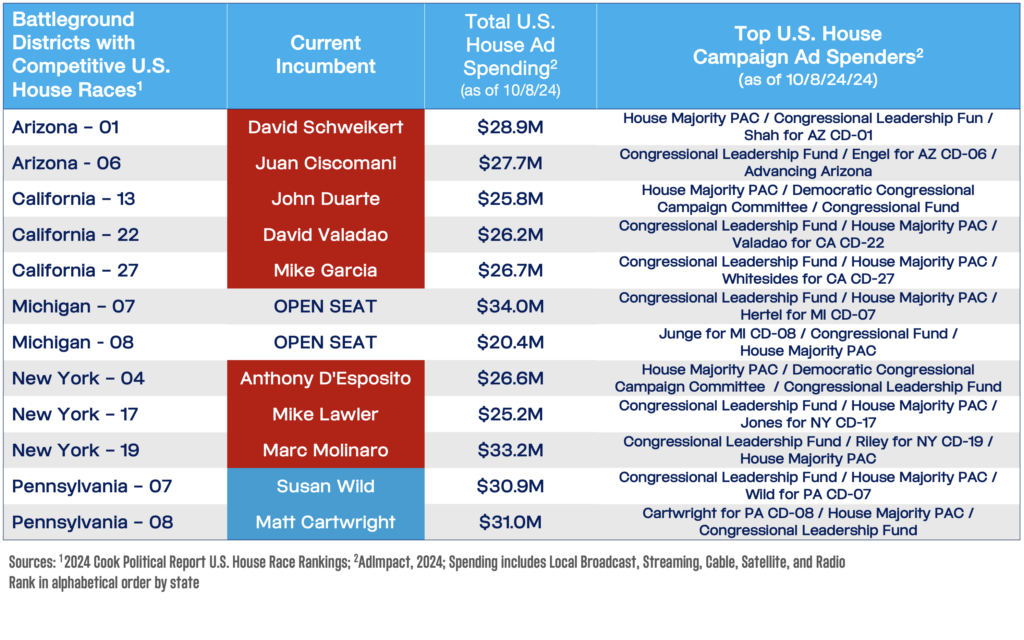

Local ad spending in competitive U.S. House races is surging as the 2024 election nears. Some of the tightest races are in California and New York, the two largest states, where Republicans are defending several vulnerable seats. In California, incumbents John Duarte (CA-13), David Valadao (CA-22), and Mike Garcia (CA-27) face fierce challenges. Meanwhile, in New York, races featuring GOP incumbents Anthony D’Esposito (NY-04), Mike Lawler (NY-17), and Marc Molinaro (NY-19) are attracting significant local political ad spending.

Beyond these two states, U.S. House races in key battlegrounds like Arizona, Michigan, and Pennsylvania are also seeing heavy investment. Arizona’s districts held by David Schweikert (AZ-01) and Juan Ciscomani (AZ-06) are drawing attention. In Michigan, two open seats previously held by Democrats—Elissa Slotkin’s MI-07 and Dan Kildee’s MI-08—are hotly contested. Pennsylvania, too, is home to tight races, with Democratic incumbents Susan Wild (PA-07) and Matt Cartwright (PA-08) fighting to hold on to their seats.

With Democrats needing just three seats to reclaim the House majority, both parties are spending heavily, and the local ad wars will continue until Election Day. These battleground districts will play a pivotal role in determining control of the U.S. House in 2024.

The chart below, using AdImpact’s data, lists U.S. House political ad spending in districts with competitive races in Arizona, California, Michigan, New York, and Pennsylvania:

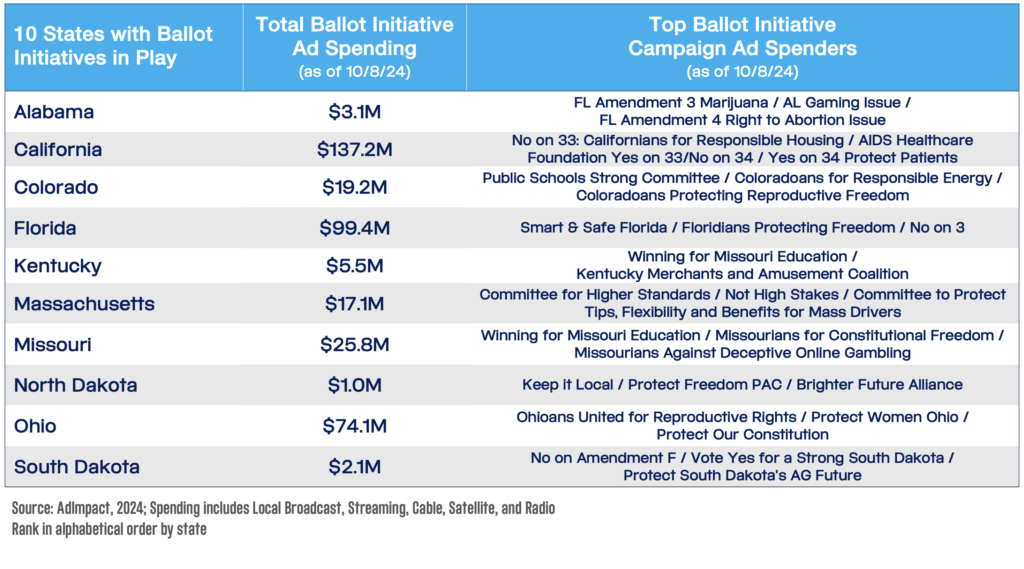

Ballot Initiatives Dominate Local Political Ad Spending

Reproductive rights remain a central issue in the 2024 election, drawing significant attention and funding. However, voters across the country are also grappling with a variety of other critical issues, with down-ballot races and ballot initiatives driving substantial ad spending.

In Florida, North Dakota, and South Dakota, marijuana legalization is at the forefront, sparking a flurry of local ad campaigns from both sides of the debate. Ohio’s redistricting initiative is also drawing attention, as the outcome could reshape the state’s political landscape for years. Meanwhile, California’s rent control measures and the school choice debates in Colorado and Kentucky have ignited intense advertising efforts, reflecting the high stakes involved in these issues.

Missouri is seeing a surge of local ads concerning sports betting, as advocates and opponents battle for voter support. Wage-related initiatives in Alabama, California, Massachusetts, and Missouri are also fueling local ad spending, as campaigns work to influence public opinion on key economic concerns.

As Election Day approaches, the importance of these ballot initiatives and down-ballot races cannot be overstated. With real-life impacts at stake, ad political spending is expected to continue rising, as campaigns seek to sway undecided voters on these crucial matters shaping local and state policy for the future.

At Locality, we are tracking every race, every ballot initiative, and many more 2024 election cycle moments that will impact ad spending across local TV and streaming. Get in touch if you’d like to discuss local advertising solutions for your campaigns. We’re always happy to chat about Politics.